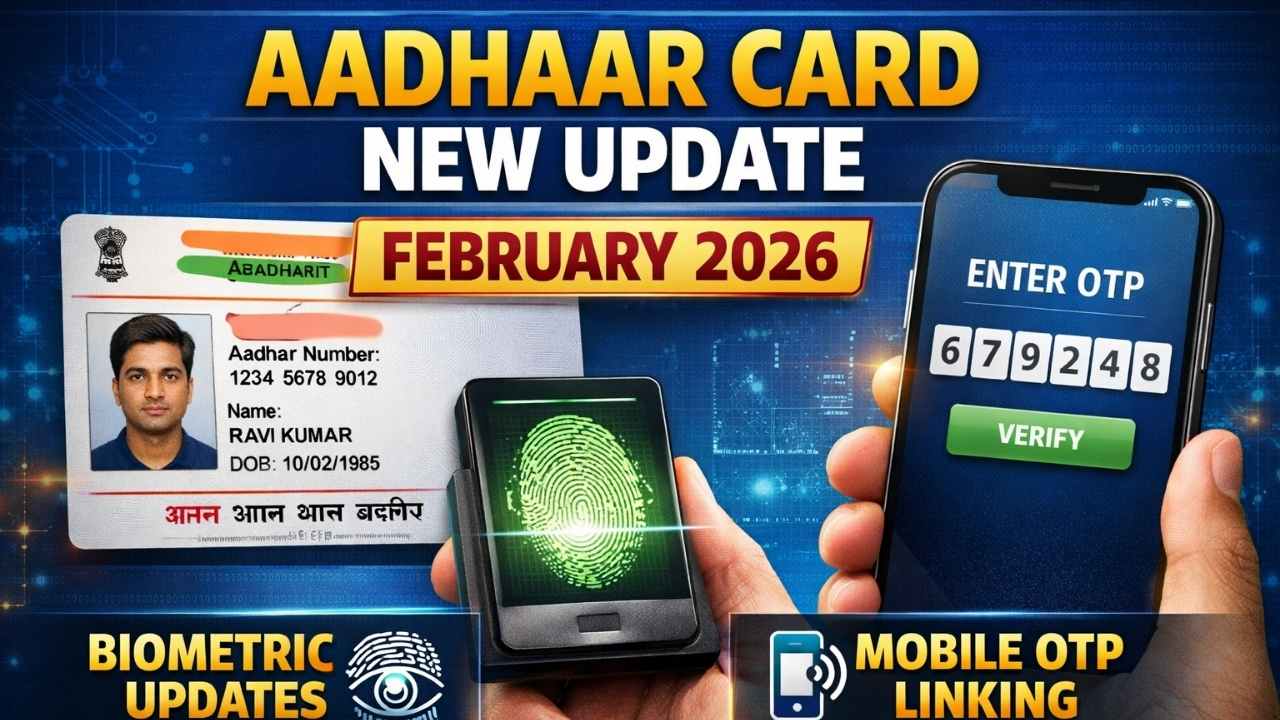

Aadhaar Card New Update February 2026: Aadhaar remains one of the most important identity documents in India, used for banking, SIM cards, government schemes, and verification services. In February 2026, several new updates were introduced to improve security, simplify mobile linking, and strengthen biometric authentication. These changes aim to reduce fraud and make services faster and more reliable.

The new rules focus on regular biometric updates, active mobile number linking, and document verification. UIDAI has also encouraged citizens to keep their Aadhaar details updated to avoid service interruptions. Understanding these changes is important to continue using Aadhaar smoothly for financial, educational, and government-related purposes.

Also Read: Senior Citizen FD Rates In 2026 Offering Safe Returns And Stable Retirement Income Options

Latest Aadhaar Update Rules Introduced In February 2026

The February 2026 update highlights stronger security measures and improved identity verification processes. UIDAI has focused on biometric accuracy, document updates, and mobile-based authentication. These updates help ensure Aadhaar remains safe and valid for official use across India.

The new rules encourage people to keep their personal details current. Many services now depend on OTP verification linked to registered mobile numbers. With digital usage increasing, regular updates help prevent misuse and protect identity.

Biometric Verification Changes And Security Improvements

Biometric verification has become more important under the new Aadhaar update. UIDAI recommends updating fingerprints and iris data if they are more than ten years old. This ensures smooth access to banking services, subsidies, and digital verification systems.

Also Read: Big Rental Law Changes in 2026 With Online Agreements and Secure Digital Registration

Children must update their biometrics at ages five and fifteen. This helps maintain accurate records as physical features change over time. Updated biometric data improves authentication success and reduces verification failures.

Aadhaar Card New Update February 2026 Overview

| Key Update Area | Details |

|---|---|

| Biometric Rule | Update recommended if older than 10 years |

| Children’s Biometric Update | Mandatory at age 5 and 15 |

| Mobile Linking | Active mobile number required for OTP services |

| Document Update | Suggested every 10 years |

| Free Document Update Deadline | Available till June 2026 |

| Security Feature | OTP and biometric dual verification |

| Aadhaar Usage | Required for banking, subsidies, and KYC |

| Update Mode | Online and Aadhaar enrollment centers |

Importance Of Linking Mobile Number With Aadhaar

Linking a mobile number with Aadhaar has become essential for accessing online services. Most updates, downloads, and authentication processes now require OTP verification. Without a registered number, many digital facilities may not work properly.

A linked mobile number helps users receive alerts and confirm identity during transactions. It also allows easier updates of address, documents, and profile details through online portals and mobile applications.

Also Read: PAN Card 2.0 Explained February 2026: New Benefits, Linking Requirement, Security Features Guide

Aadhaar Document Update Guidelines And Timeline

UIDAI suggests updating Aadhaar documents periodically to maintain accurate records. Address and identity proof updates help avoid issues during verification for government schemes and banking services.

A free document update facility is available until June 2026. After that, a small fee may apply for online and offline updates. Regular updates ensure that Aadhaar remains valid and usable for official purposes.

Aadhaar Authentication Rules For Banking And Government Services

Aadhaar authentication is widely used in banking, pension verification, and welfare schemes. The new system includes stronger checks through biometric and OTP-based confirmation. This reduces the chances of identity misuse.

Also Read: Latest Home Loan Interest Rates 2026: Comparison Of Top Banks Offering Affordable Housing Finance

Financial institutions use Aadhaar for KYC verification and secure transactions. Updated biometric and mobile-linked Aadhaar helps users avoid delays in services like subsidy transfers and account verification.

Aadhaar Update Process At Enrollment Centers And Online

Aadhaar details can be updated both online and at enrollment centers. Address and document updates can often be done digitally, while biometric updates usually require a physical visit for accurate verification.

Enrollment centers provide support for mobile number linking, biometric updates, and corrections. Keeping records updated ensures continued access to services and reduces chances of rejection during identity verification.

Benefits Of Regular Aadhaar Data Verification And Updates

Regular Aadhaar updates help maintain correct personal information. This improves verification success rates when applying for loans, SIM cards, and government benefits. Updated records also help prevent service disruptions.

Keeping details current ensures faster authentication across platforms. Accurate biometric and document data also improve security and help authorities identify genuine users more efficiently.

Security Features Added To Protect Aadhaar Identity

New security improvements include stronger authentication methods and better data protection systems. OTP verification combined with biometrics adds an extra layer of safety for users during important transactions.

Also Read: SBI 1111 Days FD Scheme 2026: Interest Rates, Tenure Details, And Maturity Value Explained

Masked Aadhaar and biometric lock features help prevent misuse of personal details. These tools allow users to control when and where their Aadhaar information is shared.

Common Reasons Aadhaar Details Need Immediate Updating

Aadhaar details may need updates due to changes in address, mobile number, or biometric mismatch. Old records can cause authentication failures and delays in accessing essential services.

Updating information on time ensures smooth usage for financial and government processes. Regular checks help maintain accuracy and prevent complications during verification or identity confirmation.

Also Read: ITC Share Price Target 2026 to 2030 Long Term Forecast and Fundamental Growth Outlook