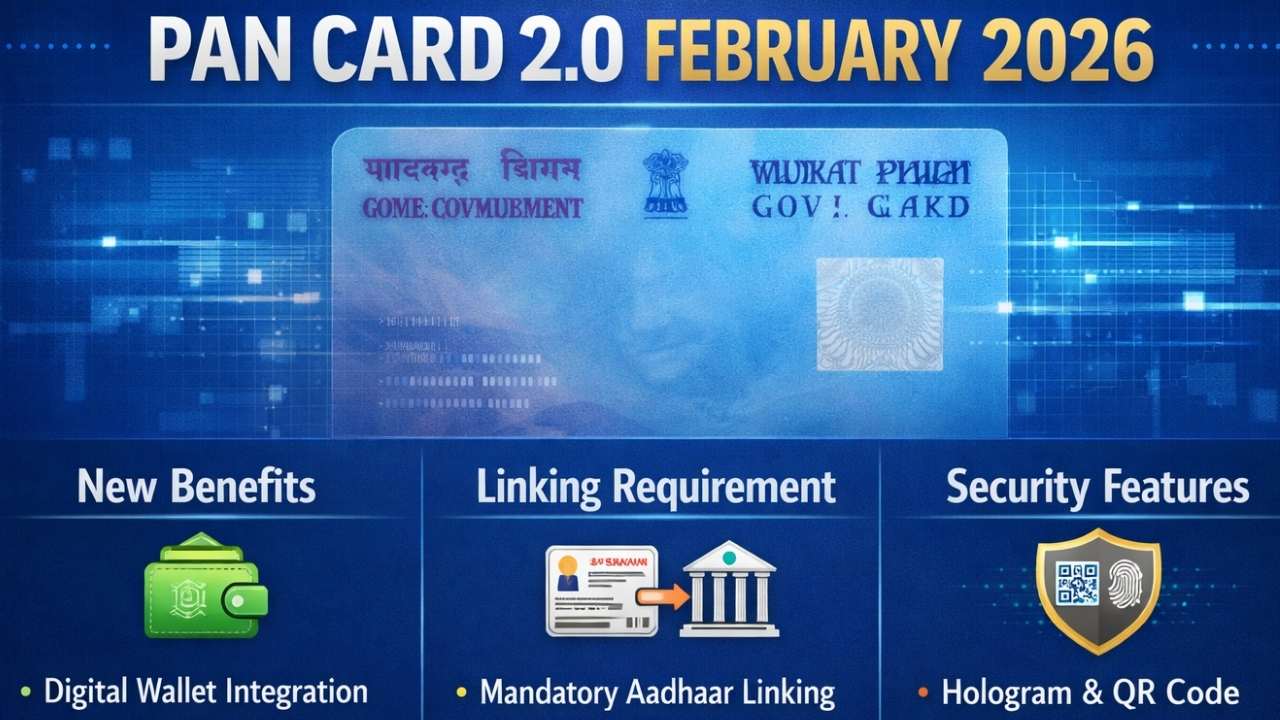

PAN Card 2.0 Explained February 2026: The PAN Card 2.0 update is an important step by the government to improve digital identity and financial verification systems in India. It aims to make the PAN system more secure, faster, and easier to use for banking, taxation, and other financial services. The upgrade focuses on better technology and improved access for citizens.

This update does not replace existing PAN cards but strengthens the current system with new features. Aadhaar linking has become a key requirement, and new rules are being implemented to improve compliance. Understanding these changes is important for individuals who file taxes, use banking services, or make large financial transactions.

Also Read: Senior Citizen FD Rates In 2026 Offering Safe Returns And Stable Retirement Income Options

PAN Card 2.0 Key Features and Digital Transformation

PAN Card 2.0 introduces advanced features like a QR code for quick verification and improved identity protection. The goal is to reduce fraud and make it easier to confirm PAN details during financial activities. This change supports digital documentation and faster processing.

The upgrade also focuses on providing a digital-first experience through e-PAN. Citizens can receive and use PAN details electronically without relying only on physical cards. This makes the system more convenient and accessible for users across the country.

Aadhaar Linking Requirement and Compliance Rules

Aadhaar linking with PAN is now a mandatory requirement for most individuals. If PAN is not linked, it may become inoperative and may not be accepted for financial transactions. This rule is meant to ensure better identity verification and prevent misuse.

Also Read: Big Rental Law Changes in 2026 With Online Agreements and Secure Digital Registration

Late linking may require a penalty fee, and individuals must complete the process to avoid problems. Once linked, users can continue using their PAN normally for tax filing and other important activities without restrictions.

PAN Card 2.0 Explained February 2026: Table Overview

| Topic | Key Details |

|---|---|

| Project Name | PAN Card 2.0 |

| Purpose | Digital upgrade of PAN system |

| Old PAN Validity | Still valid and usable |

| New Features | QR code, e-PAN, centralized database |

| Aadhaar Linking | Mandatory for most users |

| Risk | PAN may become inoperative if not linked |

| Benefits | Faster verification, better security |

| Usage Areas | Banking, tax filing, investments |

| Penalty | Late linking may require fee |

| Government Aim | Stronger digital identity system |

Government Rules for PAN Usage in Financial Transactions

New rules are being introduced to expand the use of PAN in financial activities. PAN may be required for high-value transactions, including large deposits and major investments. This helps the government track financial activity and reduce tax evasion.

These rules also ensure that financial systems remain transparent and secure. By using PAN as a common identity proof, authorities can improve monitoring and make financial operations more organized and reliable.

Also Read: Aadhaar Card New Update February 2026 Explains Biometric Updates, Mobile OTP Linking Benefits

Benefits of QR Code Enabled PAN Card

The QR code feature allows instant access to verified PAN details. This helps banks and financial institutions confirm identity quickly and reduces the chances of fake PAN usage. It also adds an extra layer of digital security.

With this feature, people can share their verified details easily when needed. It supports smoother service access and ensures that identity information remains accurate and up to date across different platforms.

Importance of e-PAN and Paperless Access

The e-PAN system allows users to receive a digital copy of their PAN directly through email. This reduces dependency on physical documents and makes it easier to store and access the card anytime.

Also Read: Latest Home Loan Interest Rates 2026: Comparison Of Top Banks Offering Affordable Housing Finance

Digital access also supports faster services like account opening and verification. It helps users manage their PAN details without delays and encourages paperless financial processes across India.

How PAN Card 2.0 Strengthens Identity Verification

The upgraded system improves identity checks across banks, tax systems, and investment platforms. A centralized database allows quick verification and helps prevent duplicate or fake identities.

This strong verification process increases trust in financial transactions. It also supports better coordination between government departments and financial institutions for secure identity management.

Consequences of Not Linking PAN with Aadhaar

If PAN is not linked with Aadhaar, it may become inactive. This can lead to difficulties in filing income tax returns and receiving refunds. Users may also face issues in opening bank accounts or making investments.

Inactive PAN can result in higher tax deductions on certain transactions. Linking Aadhaar helps avoid these problems and ensures continued access to financial and tax services.

Validity of Old PAN Cards Under the New Update

Existing PAN cards remain fully valid under the new system. There is no requirement for everyone to apply for a new PAN card. The update mainly improves technology and services linked to PAN.

Also Read: SBI 1111 Days FD Scheme 2026: Interest Rates, Tenure Details, And Maturity Value Explained

People can continue using their current PAN for tax and banking purposes. The government may provide updated digital versions, but the permanent account number itself does not change.

Role of PAN in India’s Digital Financial Future

PAN is becoming an essential identity document for financial and tax-related services. The upgrade supports the country’s digital growth and helps simplify access to important services.

As financial systems become more connected, PAN will play a bigger role in secure transactions. The modernization aims to make financial processes safer, faster, and more efficient for citizens across India.

Also Read: ITC Share Price Target 2026 to 2030 Long Term Forecast and Fundamental Growth Outlook